Cash Management

Improve reconciliation accuracy by using the document number for bank interest and charges

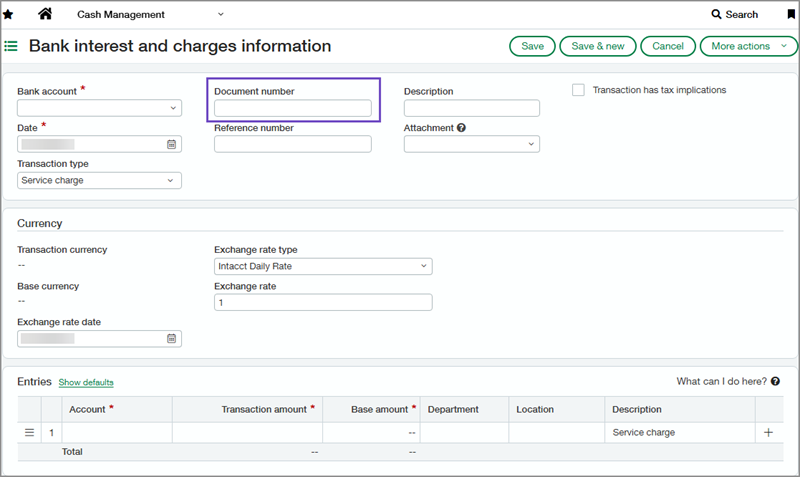

Improve accuracy when reconciling bank accounts by using the new Document number field on the Bank interest and charges page. This field is shown on all pages and reports that include a document number, for example the Bank interest and charges information page.

Key benefits

Modern payment services might charge a fee when processing a customer's payment, which is deducted from the resulting bank deposit. This enhancement helps to improve accuracy and reduce matching errors.

- Accurate bank reconciliation: Use a shared document number, such as the transaction number from your bank statement, to precisely match payment fees and customer payments to the bank credit.

- Faster, more reliable matching: In your matching rule, group by document number and match on Amount (combine debits and credits) to reduce manual intervention and speed up reconciliation.

- Fewer matching errors: Help prevent mismatched transactions and improve data accuracy.

- Clear audit trail: Link the fee and the payment with a common identifier to create a cleaner record for review and auditing.

Permissions and other requirements

| Subscription |

Cash Management |

|---|---|

| Regional availability |

All regions |

| User type |

Business |

| Permissions |

Bank interest and charges: Add, List, View |