Taxes

Support for taxes in the Republic of Ireland—Early Adopter

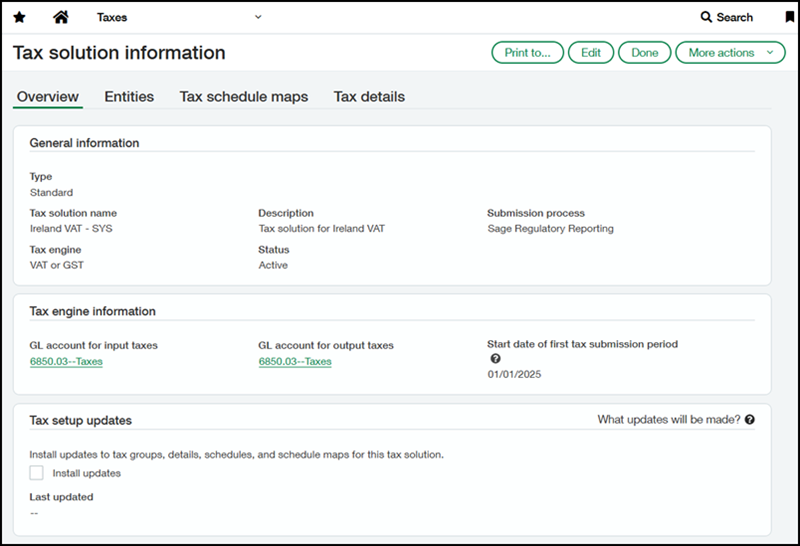

To facilitate tax calculation and reporting, we added a tax solution for the Republic of Ireland to our list of standard tax solutions. This tax solution provides an automated setup for the tax rates for domestic VAT in the Republic of Ireland.

Key benefits

This new standard tax solution provides pre-configured tax details and tax schedules for domestic VAT for the Republic of Ireland. If your company or entity uses this tax solution, you can also install custom reports that give you summary- and detail-level insight into your taxable transactions.

What's the Early Adopter program?

The Early Adopter program allows a select group of customers to test and provide feedback on new features. Your input will help us refine and improve these features before the general release.

Permissions and other requirements

| Subscription |

Taxes |

|---|---|

| Regional availability |

|

| User type |

Business user with admin privileges |

| Permissions |

Taxes

|